tax shield formula cpa

Depreciation is considered a tax shield because depreciation expense. We can also handle your individual tax.

Financial Modeling Archives Page 2 Of 7 Universal Cpa Review

Ad Get the Most Comprehensive Resource for Understanding Applying GAAP Literature.

. 401k medical Job Description. CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1. 7 years of taxaccounting experience.

Present value PV tax shield formula. The shortened definition of a Tax Shield is any item that can lower taxable income while also lowering the taxes a person must pay. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Ad Read Customer Reviews Find Best Sellers. ERTC can greatly improve business cash flow.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Over a month ago. CPA Canada s Reference Schedule of allowances and tax rates used in their Core evaluations Keywords.

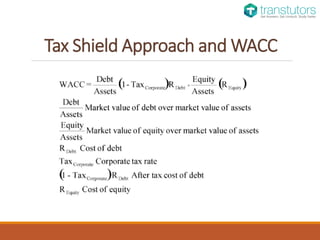

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Clients In 50 Countries. California Cannabis CPA is the premier cannabis CPA firm for individuals and companies in legalized medical and recreational states across the country who are looking for assistance in.

In general a tax shield is anything that reduces the taxable income for personal taxation or corporate taxation. Thus if the tax rate is 21 and. Ad A quick call with our ERTC advisors could generate big tax relief for your business.

Proven engagement and staff management skills. What is the formula for tax shield. Ad Cross New Borders With Confidence.

But if we avail the option to convert the bond the net value of lost tax shield is. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of Total Tax Shield from CCA for a New Asset Notation for above.

Interest Tax Shield Interest Expense Deduction x Effective Tax Rate Interest Tax Shield 4m x 21 840k While Company A does have a higher net income all else being equal Company B. Fantastic opportunity for a Tax Accountant to work in a prominent CPA firm in Los Angeles. Free 2-Day Shipping wAmazon Prime.

Bachelors andor Masters degree in Accounting. The tax shield Johnson Industries Inc. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250.

How to Calculate a Tax Shield Amount The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. There are two simple steps to calculate the Depreciation Tax Shield of a company or individual. Contact us today for a quick assessment.

There are several deductions in the tax field. The applicable tax rate is 37. We speak your language.

We know the languages cultures and business climates of where you do business. CPA CFE REFERENCE SCHEDULE 2018 1. We care about the success of each one of our clients and work hard to deliver accounting and bookkeeping services to save you time and resources.

Fi Chapter 1 Capital Budgeting Flashcards Quizlet

Wealthability For Cpas On Apple Podcasts

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Tax Shield Formula Step By Step Calculation With Examples

:max_bytes(150000):strip_icc()/Term-Definitions_freecashflow_FINAL-ebecf2a8576047c0a8b9446f29b63b71.png)

Free Cash Flow Fcf Formula To Calculate And Interpret It

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Tax Shield Definition Formula Example Calculation Youtube

Depreciation Tax Shield Formula And Calculator Step By Step

Wiley Cpaexcel Exam Review 2016 Study Guide January Regulation Wiley Cpa Exam Review Whittington O Ray 9781119119975 Amazon Com Books

Tax Shield Definition And Formula Bookstime

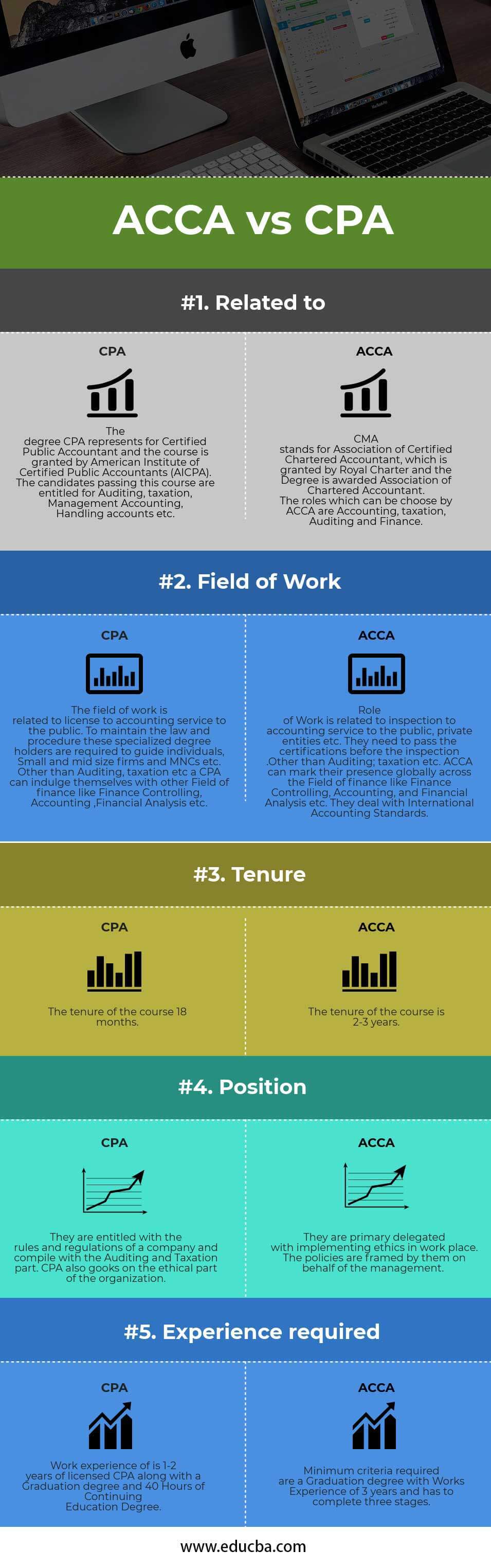

Acca Vs Cpa 5 Best Differences To Know With Infographics

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download

How To Calculate The Casualty And Theft Loss Deduction For A C Corporation Universal Cpa Review