b&o tax credit

It is a type of gross receipts tax because it is levied on gross income rather than net income. Small business tax relief based on income of business.

Members of Wheeling City Council now will vote in early February on a one-time BO Tax credit program for small businesses that was approved by the citys Finance Committee early this evening.

. Its really that simple. Up to 75 of your contribution to SDA in 2012 may be used against your 2013 BO or PUT tax liability. The state BO tax is a gross receipts tax.

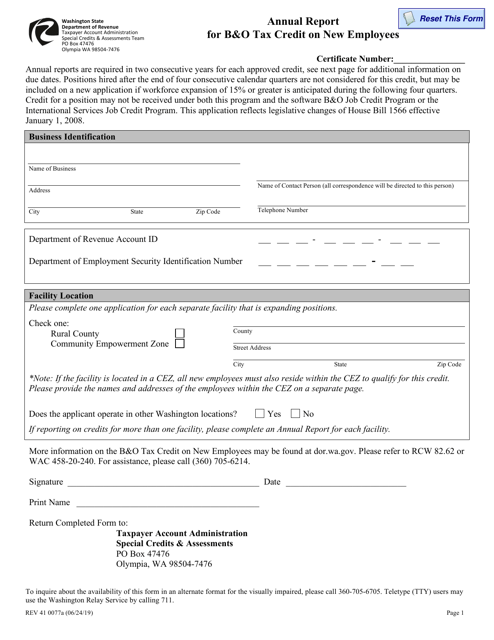

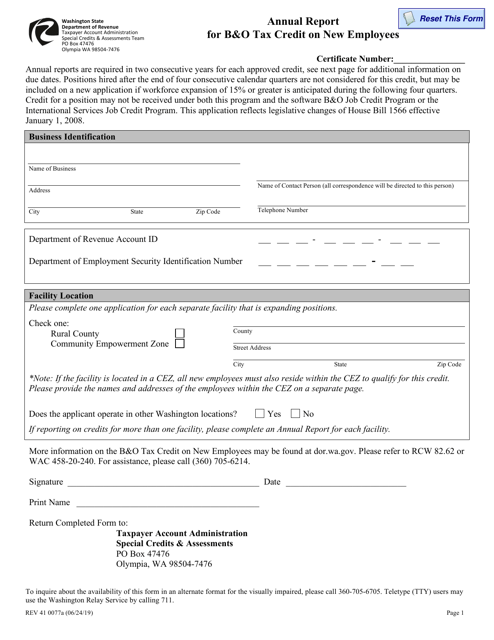

Business and occupation tax overview. The amount of small business BO tax credit available. Full-Time Employees For a full-time employment position to be eligible for credit it must be requested by application before the new position is filled.

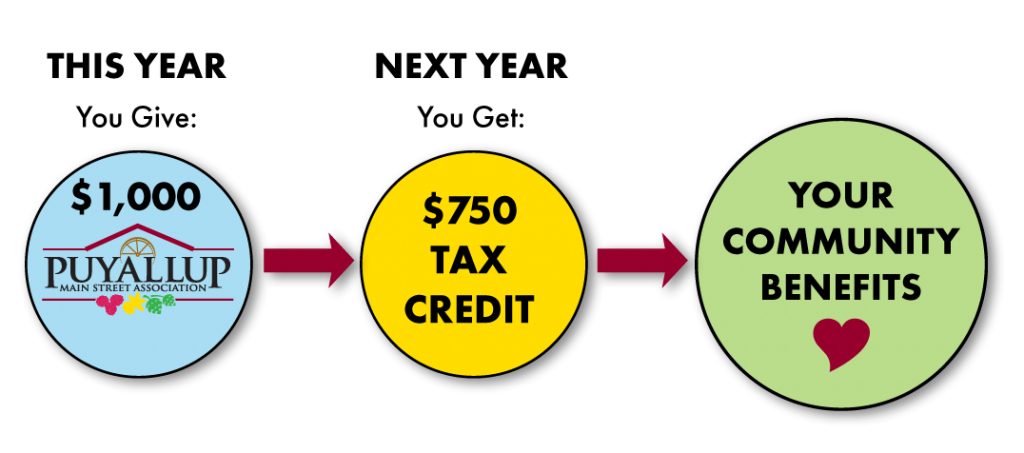

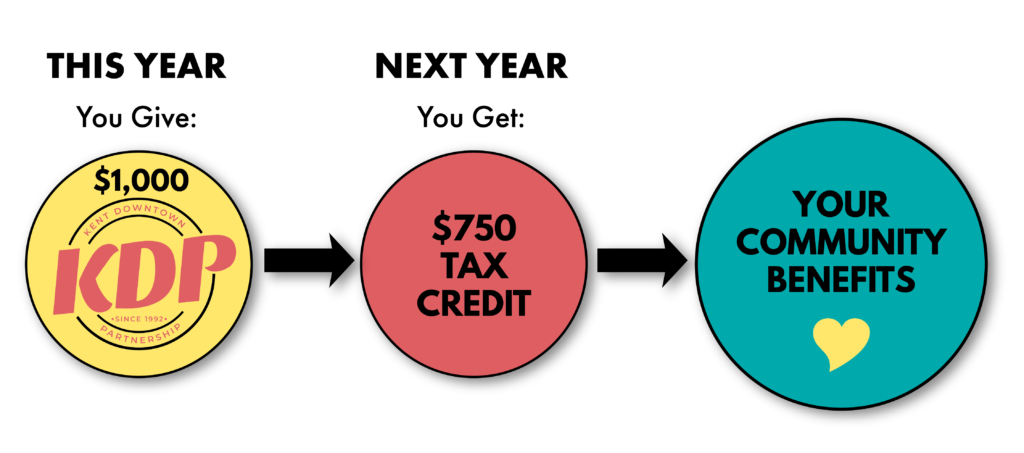

Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization. The credit is taken against the BO tax for each new employment position filled and maintained by qualified businesses located in eligible areas. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown.

A new application must be submitted to the. For example if you extract or manufacture goods for your own use you owe BO tax. To pay your sewer bill on line click here.

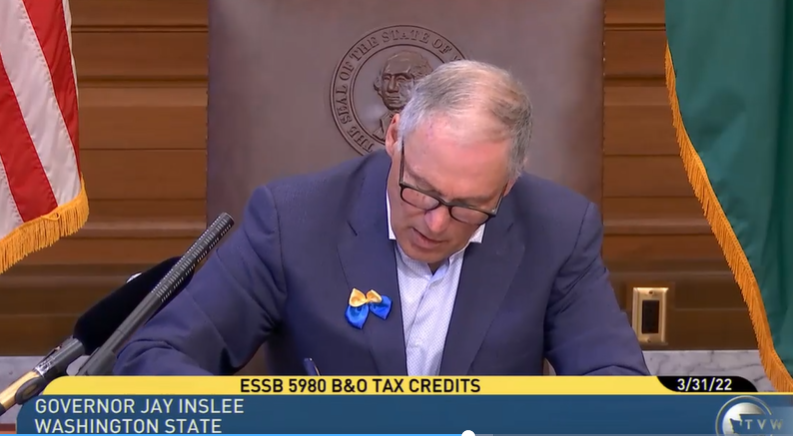

Washington State is considered one of the better tax states in no small part because of its Small Business BO Tax Credit. The major classifications and tax rates are. Small Business Thanks Governor For Signing B O Tax Credit Bill Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown.

By exempting firms with up to 125000 in gross receipts from the Business Occupations Tax BO and expanding the Small Business Tax Credit to those enterprises earning nearly 250000 annually Senate Bill 5980 will provide welcome relief for some 276000 small businesses. A pledge of 1000 equals a tax credit of 750 that will be applied to your 2023 B O tax obligation. Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax.

You can make the donation by sending a check to the following address. Beginning October 1 2016 businesses that hire unemployed veterans may qualify for credit against their State business and occupation BO tax or public utility tax PUT. Credits may be carried over until July 1 2026.

States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky. As your income goes up you get a smaller and smaller credit until you make enough to pay the full percentage. Box 771 Gig Harbor WA 98335.

So for example if you pay ServiceOther B O annually and your annual business income is 56000 this gross income is tax-free. The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility Tax PUT credit for private contributions given to eligible downtown organizations. Washington unlike many other states does not have an income tax.

Additionally a portion of your tax. If you make 122000 or. Multiple Activities Tax Credit MATC Small Business BO Tax Credit.

Washington unlike many other states does not have an income tax. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. In 2020 when you go to pay your BO online you will be given the amount of your credit in a drop-down menu and asked how much you would like to apply.

If youre unsure how your business is classified the Department of Revenue provides a list of common business activities and their corresponding tax classification s. Because Sumner Main Street Association is a 501 c 3 non-profit organizations other tax incentives may apply. Small Business B.

In January 2023 when you go to pay your BO online you will have the credit available in your account. The credit equals 20 percent of the wages and benefits a business pays to or on behalf of a qualified employee up to a maximum of 1500 for each. The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US.

Please call the SMSA office at 253 891-4260 or email us. This article authored by Scott Schiefelbein and Robert Wood 2 provides helpful tips regarding some of the nexus traps the BO tax poses for the unwary company seeking to do business in Washington and was originally published in the spring issue of the Oregon State Bar Taxation Section Newsletter. Mail your check to.

No cash may be dropped off at any time in a box located at the front door of Town Hall. This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451. I would also like to thank Sen.

Service and Other Activities. Washingtons BO tax is calculated on the gross income from activities. Wheeling Finance Committee Approves BO Tax Credit.

High Technology B. It is measured on the value of products gross proceeds of sale or gross income of the business. Make your payment to The Alliance by Tuesday November 15 2022.

This means there are no deductions from the BO tax for labor. Check with your accountant for further details. New BO Tax Credit.

While deductions are not permitted for labor materials or other overhead expenses the State of Washi. Box 771 Gig Harbor WA 98335. The tax credit may not exceed the BO tax amount due.

There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year. Effective June 7 2006 businesses that participate in the Washington Customized Training Program may take a BO tax credit for 50 percent of their payment to the training program. Its really that simple.

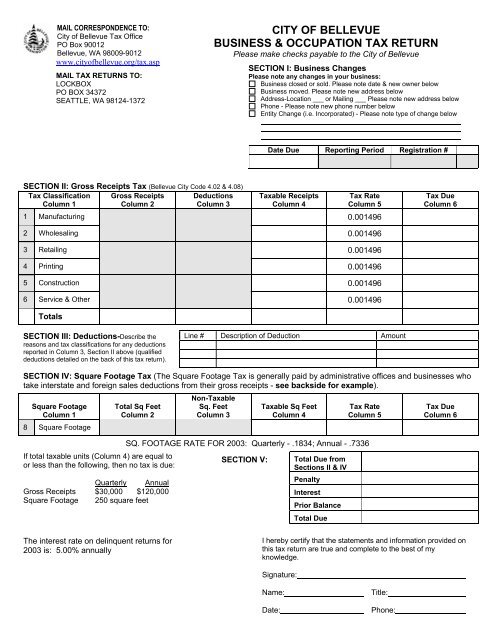

The City Business Occupation BO tax is a gross receipts tax. This means there are no deductions from the BO tax for labor. Donate 1000 and receive a credit of 750 applied to your 2023 BO tax obligation.

The proposal would allow small businesses. Puyallup Main Street Association. It is measured on the value of products gross proceeds of sales or gross income of the business.

This credit is commonly referred to as the small business BO tax credit or small business credit SBC. The Downtown Waterfront Alliance PO. Market Vines is a popular destination at Centre Market.

Check with your accountant for more information. Reuven Carlyle for his leadership. Electronic filing of all returns documents and surveys is.

B O Tax. However your business may qualify for certain exemptions deductions or credits. Washingtons BO is an excise tax.

The BO tax for labor materials taxes or other costs of doing business. Because Buckley Downtown Association is a 501 c 3 non-profit organizations other tax incentives may apply. Tax payments checks only.

For small a Washington corporation or LLC it. Both Washington and Tacomas BO tax are calculated on the gross income from activities. Rural County B.

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

B O Tax Credit Program Sumner Main Street Association

Business And Occupation B O Tax Washington State And City Of Bellingham

Form Rev41 0077a Download Fillable Pdf Or Fill Online Annual Report For B O Tax Credit On New Employees Washington Templateroller

Small Business Thanks Governor For Signing B O Tax Credit Bill

B Amp O Tax Return City Of Bellevue

B O Tax Credit Incentive Program Downtown Waterfront

Washington Main Street B O Tax Incentive Program Bainbridge Island Downtown Association

Form Rev41 0077a Download Fillable Pdf Or Fill Online Rural Area Annual Report For New Employee B O Tax Credit Washington Templateroller

B O Tax Program Puyallup Main Street Association

Projects Programs Kent Downtown Partnership

Self Employed Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller